Did you know that over 65% of all trades in the U.S. stock market are now placed through mobile trading apps? With the rise of smartphones and growing interest in personal finance, more people than ever are turning to a stock trading app to invest in the market right from the palm of their hand.

As demand continues to grow, businesses and fintech startups are eager to build trading apps tailored to modern users. From sleek design to real-time data and security features, today’s custom trading app solutions offer much more than just buying and selling stocks; they aim to create a complete financial ecosystem.

In this complete guide, we’ll break down the essential features, development costs, and everything you need to know about creating or choosing the perfect stock trading app. Whether you’re comparing the best trading apps, looking for the best stock trading app for beginners, or evaluating top online trading apps and investment apps for beginners, this guide will help you make informed decisions to match your goals. Get ready to explore the future of custom trading app solutions.

A stock trading app is a digital platform that allows users to buy, sell, and manage stocks and other financial assets right from their smartphones or desktops. These apps connect directly to brokers or exchanges, making trading more accessible, faster, and user-friendly. The best stock trading apps offer features like real-time stock alerts, live charts, instant trade execution, and portfolio tracking to help users make informed decisions.

Modern apps have evolved into full-fledged multi-asset trading platforms, supporting not just stocks but also ETFs, commodities, and even crypto, creating powerful cryptocurrency and stock trading app experiences. Many platforms also cater to beginners, offering simple dashboards, learning tools, and demo accounts, making it easier to find the best stock trading app for beginners in 2025.

For startups or fintech companies aiming to tap into this growing market, investing in cross-platform trading app development is a smart move. By working with experienced teams or choosing to hire trading app developers, businesses can build secure, and user-friendly fintech apps that stand out in today’s digital investment landscape

When exploring stock trading apps, understanding the different types can help you choose the right platform based on your investment goals. Broadly, these apps fall into two main categories: discount brokers and full-service brokerage platforms.

1. Discount broker apps are ideal if you're looking for a simple trading app with low or zero commission fees. They offer essential tools for trading via mobile, fast execution, and basic research, perfect for those who want a beginner trading app that’s easy to use without overwhelming features. These platforms suit users who prefer to manage investments independently.

2. Full-service brokerage platform is designed for investors who want more than just order placement. These apps provide advanced tools, in-depth research, expert guidance, and sometimes even human advisors. With expert trading features, they’re perfect for serious investors or professionals looking for a powerful digital stock investment app or online investing platform with all the bells and whistles.

3. Hybrid Trading Apps: These platforms offer the best of both worlds' user-friendly interfaces with optional advisory support or robo-advisors. They're popular among startups building custom trading app development solutions that balance simplicity and depth.

4. Crypto and Stock Trading Apps: Apps that allow users to invest in both cryptocurrencies and traditional stocks. With rising demand for diversified portfolios, many new-age investors prefer a single app to manage all assets securely.

5. AI-Driven Smart Trading Apps: Powered by machine learning, these apps provide automated investment strategies, predictive analytics, and intelligent portfolio optimization.

6. Social Trading Apps: These platforms focus on community-led investing where users can follow, copy, or learn from expert traders. Social trading is growing as a way to build trust and engagement especially with Gen Z investors.

You should also consider whether a mobile app or stock market web app fits your trading style better. Mobile apps offer convenience and speed for on-the-go trading, while web platforms may offer more robust charting and analysis tools. The best solution often lies in apps that offer both giving users the freedom to switch between devices without losing functionality.

A well-designed mobile trading app or stock trading software can unlock growth, trust, and profitability in the competitive finance industry. If you're thinking of entering this space, here are some strong reasons why building a stock trading app in 2025 makes perfect sense:

- Rising Demand for Digital Stock Investment Apps: More users prefer online investing platforms over traditional brokers due to speed and convenience.

- Massive Growth in Fintech Market: The global fintech space, including stock app development, is projected to grow exponentially in 2025.

- Increased Mobile Trading Activity: The Majority of retail traders now rely on trading via mobile, making mobile-first development a must.

- Demand for Secure & Custom Solutions: Users are seeking trusted, feature-rich, and custom trading app solutions with high-level security.

- Cross-Platform Reach: Offering both stock market web apps and mobile apps boosts engagement and accessibility.

- Brand Positioning in the Fintech Ecosystem: A well-built app positions your brand as an innovative player in the competitive fintech stock trading app space.

Creating a custom stock trading app in 2025 isn’t just about keeping up with fintech trends, it’s about unlocking long-term business growth, improving user engagement, and tapping into the future of investing. Here are the key benefits:

1. 24/7 Accessibility for Users: With a mobile investing app, users can trade anytime, anywhere, leading to higher activity and stronger platform loyalty.

2. Faster & Real-Time Trading Experience: A well-built real-time stock trading app enables instant order execution, market alerts, and live data, giving users the speed and accuracy they demand.

3. Enhanced Data Security & User Trust: By integrating KYC, AML, and advanced security measures like encryption and two-factor authentication, you ensure compliance and protect investor data building long-term trust.

4. Revenue Generation Opportunities: From subscription plans to transaction fees and premium tools, the trading app revenue model is highly scalable with multiple income streams.

5. AI-Powered Insights for Better Decision-Making: Integrating AI and machine learning helps deliver personalized insights, smart notifications, and even trading bots, improving user outcomes.

6. Better User Retention & Brand Loyalty: A seamless interface, real-time stock alerts, and portfolio tracking help retain users longer and strengthen brand engagement.

7. Stand Out in the Digital Finance Space: Launching your own online stock trading app puts your brand at the forefront of fintech innovation and positions you as a leader in the future of investing apps.

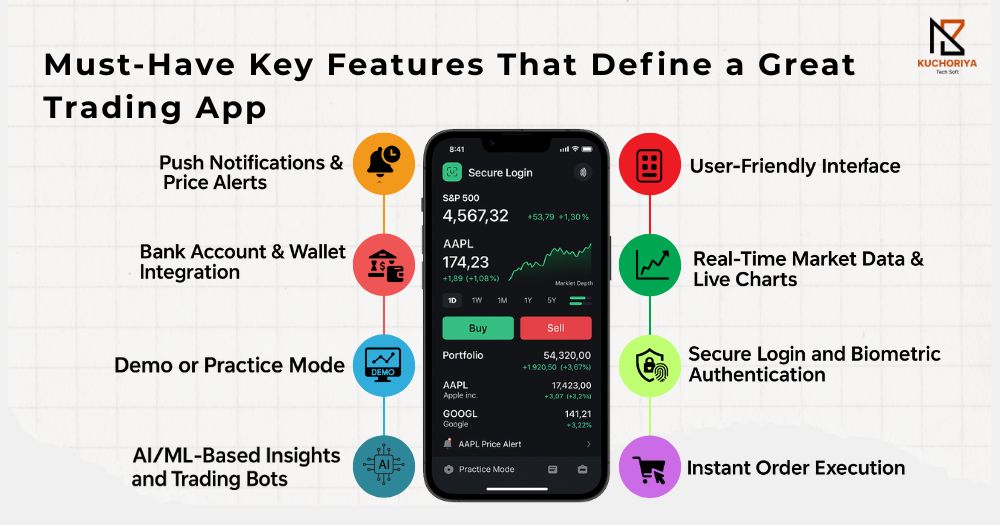

In today’s competitive market, building the best app for trading stocks means offering more than just basic buy/sell options. A successful real-time trading app must combine performance, security, and user experience to truly stand out. Below are the key features every modern stock trading app should include:

1. Effortless Onboarding & Secure Authentication

A frictionless onboarding process is essential. Offer multiple sign-in options like PIN codes, biometrics, and two-factor authentication (2FA) to guarantee security without discouraging users.

2. Comprehensive User Profile & Preferences

Allow users to personalize their experience, save personal info, notification preferences, trading frequency, and fund settings. A powerful user profile dashboard boosts engagement and user trust.

3. In-App Trading & Order Management

Seamless execution enables users to place buy/sell orders, choose order types, and track funds, all within the app. Fast, accurate order flow visualization is critical.

4. Real-Time Portfolio & Deposit Tracking

Users need real-time insights into their holdings and fund movements. Providing a dynamic portfolio view and live deposit status builds transparency and confidence.

5. Robust Search, Watchlists & Smart Alerts

Enable quick stock searches, customizable watchlists, and actionable alerts (e.g., price thresholds, volume spikes). This empowers users to stay on top of market moves.

6. Advanced Charting & Market Analytics

Integrate powerful charting tools (candlestick, line charts) and key technical indicators (RSI, MACD, Bollinger Bands). Procuring advanced analytics enables informed decision-making.

7. Newsfeed & Market Insights

Embed a curated newsfeed featuring IPO updates, M&A, sector performances, and more. Keeping users informed fosters deeper engagement and informed trading.

8. Secure Financial Transactions

Enable instant deposits and withdrawals, with real-time tracking and integration across payment gateways. Users should feel confident their funds are safe and accessible.

9. AI-Powered Tools & Portfolio Insights

Leverage AI-driven analytics for smart stock recommendations, risk assessment, and performance monitoring. Next-gen users expect data-backed insights to guide trading.

10. Push Notifications & Custom Alerts

Stay ahead of market movements with real-time push notifications and customizable alerts. This feature ensures traders never miss a critical opportunity, especially in volatile market conditions.

11. In-App Support & Educational Resources

Offer live chat, chatbot support, FAQs, and in-app tutorials to assist users in real time. Educational sections help onboard new traders and deepen user engagement.

Creating the best app for stock trading involves more than just writing code. From UI design to backend systems and ongoing support, understanding the full picture of trading app development cost is crucial for planning your project effectively.

Below is a breakdown of the key cost components involved in developing a mobile stock trading app or a crypto and stock trading app in 2025:

At Kuchoriya TechSoft, we offer the best stock trading app development services along with expert CTO services and virtual CTO services tailored for startups, fintech companies, and enterprises. Whether you need a feature-rich mobile stock trading app, a secure crypto and stock trading platform, or a multi-asset trading solution, our team delivers high-performance apps with capabilities and enterprise-grade security.

APIs enable your app to seamlessly connect with stock exchanges, brokerage systems, financial data providers, payment gateways, and more. They allow developers to add robust features without reinventing the wheel, significantly reducing development time and cost while ensuring regulatory compliance and performance.

Must-Have APIs for a Stock Trading App

1. Market Data APIs

These APIs provide real-time stock quotes, market depth, historical data, and news feeds.

Examples: Alpha Vantage, Yahoo Finance API, IEX Cloud, Polygon.io

2. Trading Execution APIs

Facilitate the execution of buy/sell orders, track transactions, manage portfolios, and route trades to exchanges.

Examples: Interactive Brokers API, Alpaca Trading API, TD Ameritrade API

3. KYC & AML Verification APIs

Ensure secure onboarding with digital KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance tools.

Examples: Jumio, Trulioo, Onfido, IDnow

4. Payment Gateway APIs

Enable instant fund deposits and withdrawals via bank transfers, cards, or wallets.

Examples: Stripe, Razorpay, Plaid, PayPal SDK

5. Financial News & Sentiment Analysis APIs

Deliver curated market news, economic indicators, and AI-powered sentiment analysis for better trading decisions.

Examples: News API, Finnhub, Benzinga API

6. Portfolio & Analytics APIs

Provide analytics on user holdings, profit/loss tracking, asset allocation, and investment trends.

Examples: Morningstar API, Xignite, Barchart

API Security and Performance Considerations

When integrating APIs into a trading app, it's crucial to prioritize:

1. End-to-end encryption

2. OAuth 2.0 and token-based authentication

3. Rate limiting and latency optimization

4. Failover and real-time syncing mechanisms

These ensure your app remains fast, secure, and ready to handle thousands of concurrent users without compromising performance. Choosing the right mix of APIs is key to delivering a feature-rich stock trading experience. At Kuchoriya Techsoft, we ensure robust security, high reliability, and seamless integration. With our expertise, your app gains the technological edge it needs to thrive in today’s competitive fintech market.

Developing a high-performing stock trading app requires a combination of market understanding, strong technical architecture, and regulatory compliance. Here’s a small breakdown to guide your journey from idea to launch:

1. Define Your App’s Core Purpose & Target Audience: Start by identifying whether your app will serve beginners, experienced traders, or both. Will it be a stock alerts app, a secure stock trading app, or a full-featured platform with multi-asset support?

2. Partner with a Trusted Trading App Development Company: Collaborate with an experienced trading app development company that understands both finance and technology. Their trading app software developers can help shape your product’s core features, user experience, and backend structure.

3. Design a User-Centric UI/UX: Create an intuitive, responsive interface for smooth navigation. A great design helps retain users and supports seamless trading on both mobile and desktop platforms.

4. Build a Robust Trading App Infrastructure: Focus on scalable architecture with real-time data processing, secure APIs, encryption, and third-party market integrations. Solid trading app infrastructure ensures speed, accuracy, and reliability.

5. Implement Security & Compliance (KYC/AML): Ensure the app meets financial regulations with features like two-factor authentication, encrypted transactions, and secure KYC/AML systems.

6. Test Rigorously & Optimize Performance: Thorough testing ensures your app is stable, fast, and error-free across devices and conditions, especially important for financial transactions and custom app development.

7. Launch & Monitor: Deploy your app on app stores and begin live trading after final approvals. Use analytics and user feedback to improve performance, and schedule regular updates.

At Kuchoriya TechSoft, our expert trading app software developers specialize in building secure, and high-performing platforms. Whether you need custom trading app development or full-cycle product delivery, we’ve got you covered.

While building a stock trading app can be rewarding, it comes with its own set of technical and operational hurdles. Here are some of the top challenges developers and businesses face:

1. Ensuring Zero Downtime & App Speed: Even a few seconds of delay can cost users a lot. App speed issues and trading latency must be minimized to support real-time trade execution, especially during market peaks.

2. Handling High-Frequency Data Streams: Live charts, order books, and market feeds generate massive data. Processing this accurately and quickly requires a robust backend capable of managing high-frequency trading data without lag.

3.Managing Customer Trust and Data Security: To build trust in a trading app, protecting sensitive information is a must. Strong encryption, secure logins, and compliance with financial regulations help protect investor data and enhance reliability.

4. Competing in a Crowded Market: With many platforms emerging, standing out requires a strong brand, performance, and smart user retention strategies. A seamless experience combined with unique features can set your app apart.

Solutions to Common Trading App Challenges

1. Build a Performance-Optimized Backend: Use high-performance cloud infrastructure, efficient data caching, and low-latency APIs to eliminate trading latency and downtime.

2.Real-Time Processing at Scale: Leverage scalable data pipelines and technologies like WebSockets for handling real-time trade execution and market updates.

3.Prioritize Security & Compliance: Integrate KYC and AML checks, two-factor authentication, and encrypted data storage to protect investor data and build trust in your trading app.

4.Implement User Retention Strategies: Incorporate features like personalized dashboards, real-time alerts, and in-app learning tools to enhance engagement and boost user retention.

Popular Stock Trading App Names for Reference

If you're planning to build your own stock trading app, it helps to understand the features and positioning of some of the top players in the market. Here are a few well-known apps that have set benchmarks:

1. Robinhood – User-friendly, commission-free trades, great for beginners

2. E*TRADE – Offers advanced tools and full-service brokerage features

3. Webull – Known for technical analysis and real-time data

4. Fidelity Investments – A trusted full-service platform with in-depth research tools

5. Zerodha (India) – One of the best discount broker trading apps in emerging markets

6. Groww / Upstox – Mobile-first platforms catering to new-age investors

These apps combine strong UI/UX, real-time alerts, and smart analytics while maintaining strict security and compliance standards.

When it comes to developing a high-performance stock trading app, security isn’t just a feature, it’s a non-negotiable foundation. Whether you're building a crypto and stock trading app, a multi-asset platform, or integrating IPTV for live financial news feeds, compliance with global security standards is essential to build trust, protect data, and prevent fraud.

Partnering with a reliable CTO service provider or hiring a virtual CTO can ensure your architecture meets both regulatory and tech-security benchmarks from day one.

1. KYC (Know Your Customer) & AML (Anti-Money Laundering) Compliance

All regulated trading platforms must implement strict KYC and AML procedures to verify user identity and prevent fraud or money laundering.

- Integrate tools like Jumio, Onfido, or IDnow for automated ID verification.

- Use AI to flag suspicious transaction patterns in real time.

- A fractional or virtual CTO service can help implement these technologies within budget.

2. Two-Factor Authentication (2FA) & Secure Login

To prevent unauthorized access, your app must offer 2FA, biometric login (Face ID, fingerprint), and secure password management.

- Use OAuth 2.0 or JWT tokens for robust session management.

- Backend login systems should include session expiry, device tracking, and IP restriction where needed.

3. End-to-End Data Encryption

From user onboarding to trade execution, all data should be encrypted in transit and at rest using SSL/TLS protocols, AES-256 encryption, and tokenization.

- Encrypt user PII, financial transactions, and communication logs.

- Hosting your infrastructure on AWS, Azure, or Google Cloud with built-in security layers is recommended.

4. Blockchain Integration for Transparency

Incorporating blockchain in trading apps is emerging as a powerful solution to improve transaction transparency and prevent fraud.

Use blockchain to record trading history and ensure audit trails.

Smart contracts can automate trade settlements and reduce human errors.

A CTO-as-a-Service model can help evaluate when and how to integrate blockchain securely and cost-effectively.

5. GDPR, PCI-DSS & Global Data Compliance

If your stock trading software serves users across countries, it must adhere to:

- GDPR for the EU (data privacy rights)

- PCI-DSS if handling any payment card information

- SEBI (India), FINRA (USA), or FCA (UK), depending on your target region

A knowledgeable CTO or virtual CTO can build a roadmap that ensures region-wise compliance while scaling operations.

6. Secure IPTV & Content Integration

If your platform streams financial news or live trading events through IPTV, you need to secure the content pipeline as well.

Use DRM (Digital Rights Management) to prevent unauthorized access to video streams

Secure IPTV endpoints with firewalls and CDN protection

Real-time IPTV feeds must be latency-optimized and encrypted

The future of stock trading apps and investing apps for beginners is being shaped by rapid tech innovation, evolving user behavior, and the demand for intelligent, secure, and mobile-first platforms. Whether you’re choosing among the best trading apps, exploring the best stock trading app for beginners, or evaluating reliable online trading apps, staying ahead of these trends will define long-term success.

Here are key trends to watch in 2025 and beyond:

- AI & ML for Smart Trading

Predictive analytics, AI-driven bots, and personalized investment suggestions are becoming standard features.

- Voice & Gesture-Based Trading

With advancements in UX, apps are exploring hands-free, voice-enabled order placement.

- Decentralized Finance (DeFi) Integration

More apps are merging traditional stocks with DeFi tools and blockchain-backed assets for hybrid experiences.

- Embedded Finance & Micro-Investing

Trading functionalities are being integrated into other platforms (e.g., banking apps), while micro-investing features attract first-time investors.

- Social & Community-Based Trading

Features like “copy trading,” live trade feeds, and in-app social communities are gaining popularity for real-time strategy sharing.

- Increased Focus on Regulation & Security

With more users, expect tighter enforcement of KYC, AML, and compliance frameworks in secure stock trading apps.

To develop a powerful and secure stock market trading app, choosing the right tech stack is essential. Below are the core tools and technologies:

Frontend (Mobile/Web UI)

- React Native / Flutter – For cross-platform mobile apps

- Swift (iOS) and Kotlin (Android) – For native apps

- React.js / Angular – For responsive web dashboards

Backend & APIs

- Node.js / Django / .NET – For scalable backend architecture

- Firebase / AWS Amplify – Real-time sync and user management

- RESTful & WebSocket APIs – For live stock updates and trade execution

Security & Compliance

- OAuth 2.0, JWT – Secure login/authentication

- SSL/TLS encryption, Biometric Auth – Secure data handling

- KYC/AML tools (e.g., Jumio, Onfido) – Regulatory compliance

Market Data & Trading APIs

- Alpha Vantage, IEX Cloud, Polygon.io, Tradier – Real-time stock feeds

- Plaid / Yodlee – Bank account and wallet integrations

- AI/ML Frameworks – TensorFlow, Scikit-learn (for smart trading features)

Testing & DevOps

- Appium, Selenium – Automated testing

- Jenkins, Docker, Kubernetes – Continuous deployment and scalability

Partner with Kuchoriya TechSoft, your trusted stock trading app development company, empowering startups and enterprises to lead in the digital investment space.

- Custom-built solutions for online stock trading apps tailored to your business model

- Expertise in stock, crypto, and multi-asset trading platforms

- Compliance-ready, high-performance systems with real-time capabilities

- Skilled trading app developers with deep fintech knowledge

- Full-cycle services to build stock trading apps from idea to launch

We combine deep domain knowledge with technical excellence to deliver secure, and innovative stock market trading apps that meet global fintech standards.

The answer is a strong yes. With the mobile investing future rapidly accelerating and users demanding faster, and more secure platforms, there’s never been a better time to build your own stock trading app. Today’s market is driven by the rise of the best trading apps, growing adoption of online trading apps, and increasing popularity of investing apps for beginners. Whether you’re planning to launch the best stock trading app for beginners or compete with the top best stock trading app solutions, the opportunity to scale is bigger than ever. From real-time data and AI-driven insights to seamless mobile experiences and top-tier security, the future of investing apps is all about innovation, speed, and trust.

As trading technology trends continue to evolve in 2025, businesses that invest now will be better positioned to lead the next wave of digital finance.

This is your moment to capitalize on opportunity and shape the future of online trading.

Ready to build your own stock trading app? Request a Free Quote Now!

Contact Kuchoriya TechSoft today and let's build the future of finance together.

Q. How much does it cost to build a stock trading app?

A. The trading app development cost depends on features, design complexity, and platform choice. On average, it can range from $30,000 to $100,000+ for a full-featured solution.

Q.. Is now a good time to invest in a trading app?

A. Yes! With the growing popularity of mobile investing and the future of investing apps looking strong, 2025 is an ideal time to launch your own online stock trading app.

Q. How do I ensure my trading app is secure?

A. Use two-factor authentication, encrypted APIs, and follow compliance practices like KYC and AML. Working with a trusted stock trading app development company ensures top-level security.

Q. Can I build a crypto + stock trading app?

A. Absolutely! Many businesses now opt for crypto and stock trading apps to offer multi-asset trading on a single platform.

Q. How long does it take to develop a stock trading app?

A. It usually takes 3 to 6 months, depending on complexity, features, and whether you're building an MVP or a full-scale product.

Q. Who should I hire to develop a trading app?

A. Partner with an experienced trading app development company like Kuchoriya TechSoft that offers end-to-end development, UI/UX design, backend infrastructure, and compliance expertise.